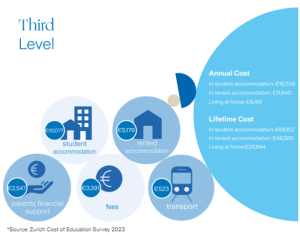

For most people, having a family requires some financial adjustments to cover the costs of childcare, education, and essentials. Not to mention all the day-to-day expenses that crop up. However, one expense is for certain … from the time your child is born you know when they’ll start school, when they’ll go to secondary school and when they’ll head to third level or off into the world. Unlike other expenses in life, you know when the education costs are coming, so with a little planning these costs don’t have to become a burden, especially when it comes to third level.

The cost of third level education is increasing every year, with accommodation causing the greatest stress for most parents. The early you can set up a savings and investment plan for your children the better. You have a timeframe and a rough idea of what you will need to support your child through third level education, if they choose this path. This immediately clarifies your investment objectives and defines the outcome for your saving and investment strategy. So how are you planning to reach this goal?

Start Saving Early

Most people try to save their child benefit (€140 per month), it’s a guaranteed monthly payment until your child turns 18 and it’s not taxed. If you can afford to save this, it can be a significant amount to help cover the cost of going to college. Of course, the sooner you start saving, the more time your money has to grow through compound interest. However, everyone’s circumstances are different so you should save what is reasonable for you. The most important thing is to start saving as soon as you can. Set up a regular contribution plan that aligns with your budget. Even small contributions can make a significant difference over the long term.

- Regular Savings Accounts: can help you achieve your savings goals. It’s a medium to long-term investment option for your savings, so if you need access to your money, that’s no problem as there are options available that give you access to your money without any penalties.

- Investment Accounts: These accounts can provide higher returns over the long term but come with more risk. Know what you’re prepared to invest? Know how long you want to invest for? What’s the minimum return you need from your investment? Can you afford to tolerate any potential storm?

- Diversify Investments: If you’re investing for the long term, diversifying your investments can help manage risk. Diversification involves spreading your investments across different asset classes to reduce the impact of poor performance in any single investment.

Avail of the Gift Tax Exemption

Another option is for grandparents to take advantage of the €3,000 tax-free annual gift allowance. Under the Small Gift Exemption each grandparent can gift up to €3,000 per child in a calendar year without having to pay Capital Gains Tax (CAT). That’s €6,000 per child per year tax free.

Every family’s financial situation is unique, so it’s important to tailor your savings strategy to your own circumstances and goals. Your savings don’t have to be earmarked for their education, maybe you want it for something else – to help with their first car, a deposit on a first home, etc. Whatever you’re saving for taking the time now to plan for their future can make all the difference in 10, 20 years. Talk to one of our financial planners for personalized guidance to help you make the right choice for your child’s future.

If we had a euro for every time someone said “I wish I had started a savings plan for the kids when they were young” …., well…

Warning: The value of your investment can go down as well as up

Warning: If you invest in this product you may lose some or all of the money you invest

Warning: This product may be affected by changes in currency exchange rates