The humanitarian crisis unfolding in Ukraine is devastating and extremely distressing.

The impact of the Russian invasion of Ukraine has unnerved global markets. Investors worried about recent events and the movement of the markets should not be quick to react. They need to hold tight… now is not the time to get out.

There is a much bigger humanitarian crisis happening now that really puts everything in perspective. However, watching the news and listening to reports coming from Ukraine has people anxious about their finances and how this will affect the cost of living. Investors anxious about stock market volatility should not panic. Talk to your financial adviser.

Investment Perspective

In the grand scheme of things movement of 5% up or down is not a big deal. In the face of a lot of negative market coverage, we tend to panic which in turn causes us to lose perspective. Many investors panic and react based on media reports rather than relying on the plan they have put in place with their financial planner. The plan you’ve put in place takes account of market fluctuations, risk tolerance, investment objectives, and market corrections.

Ignoring your financial plan at times like this can seriously hurt your financial future directly. Think before you act… The markets have always, throughout time, fluctuated and corrected. Market corrections are never far away if history is anything to go by.

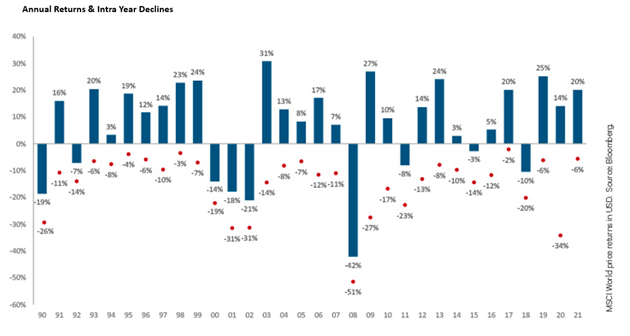

The graph below from Bloomberg shows us market fluctuations in the last 40 years as well as the full-year returns.

What do we know:

- Market fluctuations are the norm

- The average temporary fall in the past 40 years has been over -14% on average

- Equity investors have benefited from a +9.4% on average full-year gain

- Major tragic events cause the markets to move, but they rebound

- Growth is achieved by staying the course

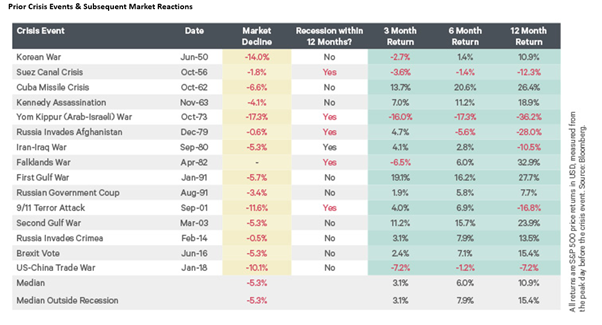

- Based on past (post-WWII) geopolitical crises the typical market reaction is a decline of between 5 – 10%, recovering within 6 months or less, as long as an economic recession is not caused by or coincides with the crisis.

Historically, the lasting effects of geopolitical events on global markets is short-lived – see below. Equity market sell-offs relating to these events tend to be short and sharp, generally recovering within a month once investors realise that the macro environment has not materially changed. De-risking your portfolio at this time can be tempting, however, we would caution against knee-jerk reactions to what’s going on at present.

Where does this leave the investor?

Current market declines are unlikely to make much difference to growth in the long term or indeed your long-term financial objectives, so it is important not to overreact and deviate from your plans.

Making decisions about your long-term investments based on your fears and emotions is not rational.

- If you have fully invested in a diversified portfolio, there is no need to do anything just yet.

- If you’re about to set up a portfolio, now would be a good time to consider the next step.

- Do you have cash on deposit that is surplus to your short-term needs, now would be a good time to consider your investment options.

You’ve invested your money for a reason that you will have discussed in detail with your Financial Planner. You will have talked through your objectives for your investment, the amount of risk you can reasonably tolerate, and you will have a portfolio in place that takes account of all this. You will also have set out a timeline for your investment goals. Now is not the time to lose your nerve!

Focus on what you can control and ignore the noise. If you are worried talk to us.