Do you live with your partner?

Not planning to “tie the knot” any time soon?

Have you thought about what might happen to your partner if anything happens to you ?

Well listen up… unfortunately when it comes to estate planning for co-habiting couples you don’t have the same legal rights & protections of inheritance as your married friends. Estate Planning, not necessarily the easiest thing in the world to think about, will be crucial for both of you to get right. Here’s a few key points to consider:

1. No automatic inheritance

Unlike married couples or those in civil partnerships, co-habiting partners do not have an automatic right to inherit from each other’s estates. If one partner dies without a will (intestate), the surviving partner may not automatically inherit any assets. Even with a Will a co-habiting partner is treated as a stranger for inheritance tax purposes and is liable for 33% tax on any inheritance over €16,250.00.

2. Make a Will!

There is no provision in the Succession Act for cohabiting partners. If one partner dies without making a Will their money and property pass to their next of kin – immediate family. When a spouse dies, irrespective of a Will or the deceased person’s wishes the surviving spouse has a legal right to one-third of their estate. Co-habiting couples have no automatic rights to a share in their partner’s estate. A co-habiting partner should be named specifically in a Will to inherit and may still be liable for inheritance tax. Creating a valid Will is crucial for co-habiting couples to ensure your assets are distributed as per your wishes. This also allows you to specify who should inherit your property, including your partner.

3. Jointly owned property

If you own property jointly with your partner, such as a house consider setting up a joint tenancy. This means that if one partner dies, their share automatically passes to the surviving partner. If you have a tenancy in common then each partner owns a specific share. This can be bequeathed to someone other than the surviving partner through a Will or it can go to the partner’s next of kin if there is no Will.

4. Cohabitant’s right to apply for provision

Some limited rights for co-habitants were introduced by legislation in 2010 regarding the provision from their partner’s estate. The surviving partner can apply to the court for provision from their deceased partner’s estate, but they must make the application within a specified timeframe. This can be costly, time consuming and stressful.

5. Life insurance and pension policies: Do you have a life insurance policy?

Have you updated your pension policy to designate your partner as a beneficiary? These measures can provide financial security to the surviving partner after the other partner’s death but, be warned they may be subject to inheritance tax. If you have a dual life policy, half will be taken as part of the deceased’s persons estate. Consider setting up a “life of another” policy on your partner.

6. Bank Accounts

Be cognisant of who pays what bills and how. If you and your partner have separate bank accounts, neither of you can have access to money held in the other partner’s account. If you are living together consider setting up a joint account for bills, etc then both you and your partner have access to the account. It is important to express to the bank your intentions in relation to the funds on death and establish whether it is ‘ joint tenancy with right of survivorship’ or ‘co-ownership’.

Spousal Exemption with Dwelling Home Relief

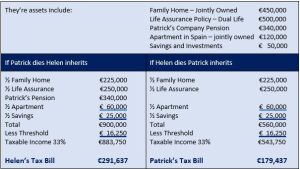

Example – Helen and Patrick have lived together for 15 years and have 2 children. They never married.

It is so important to take the time to consider inheritance tax when purchasing a home or starting a family – whether you’re married or not. Without a Will a cohabiting partner may not be entitled to their partner’s assets however, there are ways to reduce or even eliminate this tax bill. Life insurance is one way to ensure your partner is not left with a large tax bill they cannot pay.

When it comes to estate planning for co-habiting couples or anyone for that matter the biggest issue is the lack of awareness. Often people do not realise the potential financial burden they could be facing. So many unmarried couples with children, a family home and savings have little or no idea of the implications when it comes to their inheritance rights. The right advice, with the right plan can help reduce the financial burden on the surviving partner and give everyone peace of mind.

If you would like to talk to someone about your potential tax liability and the solutions available to you and your partner contact us on advice@olearys.ie . You can also click here or the button below to book an Estate Planning Session.

You should seek your own professional Tax and Legal Advice. The information here is a guideline only and does not take into account your particular circumstances.